A HOMEBUYER’S GUIDE TO PRICE VERSUS VALUE IN SCOTLAND BY DANIEL MCLARDY

In Scotland, unlike other nations of the UK, it is a legal requirement for residential property sellers to make a home report available to all prospective buyers of the public so they can make a purchase decision on a transparent, informed basis. This home report costs the seller somewhere in the region of £400 - £700, and is conducted by a fully qualified chartered surveyor, making it a significant and serious factor in residential property transactions. The report consists of 3 main sections, but here I want to discuss just one vital element – the valuation.

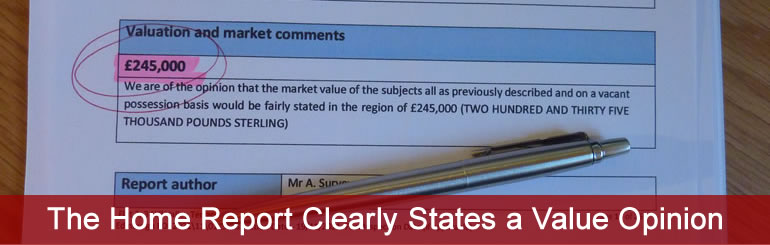

WHAT IS THE HOME REPORT VALUE?

The home report value is the market value opinion of the surveyor, and it is clearly stated within the document.

HOW DOES PRICE VERSUS VALUE ARISE?

To explain this, firstly I must make the point that because a home report is conducted by a chartered surveyor, the chosen mortgage lender will use the home report value for lending purposes. In most cases, as far as the lender is concerned, the home report value IS the value. Although this may seem counterintuitive, the value of the property is determined before the price discovery process has taken place (a successful buyer agreeing a price with the seller after competing with other buyers). Now, I do have an opinion about this, but I’ll stay focussed on the subject matter, which is that when a price is agreed for a home in Scotland there is a strong chance that it will differ from the home report value, and the impact of this can be significant in a strong market.

HOW DOES THIS CAUSE CHALLENGES FOR BUYERS IN A STRONG MARKET?

In a strong market it is more likely you will need to offer a price above the home report value to successfully compete against other buyers. However, remembering that the lender will use the home report value for mortgage loan purposes, the amount of money you offer above value must come from your own cash resources. This “price excess” does not form a part of the mortgage loan calculation, and you should think of it as a separate part (or pot) of the transaction that you must fully fund yourself.

I DON’T UNDERSTAND, CAN YOU GIVE AN EXAMPLE?

Let’s say you have a Decision in Principle from a lender for a loan of £160,000 against a property value of £200,000, meaning you have a £40,000 (20%) deposit. You’ve found a property you really like with a home report value to match, but you are advised by your solicitor that to compete as a buyer you will need to offer £215,000. That’s £15,000 above home report value; a significant amount of money that you need to address to be in the race.

HOW DO I DEAL WITH THIS EXCESS ABOVE HOME REPORT VALUE?

There are 2 options:

(1) USE READY CASH TO BRIDGE THE GAP

Often easier said than done, but if you have ready access to the £15,000 it is a valid route. This can disappoint buyers who want to keep funds aside for any future rainy days, or need to revert to asking for a gift of money from parents when they originally decided to buy their home without parental assistance. If finding the extra cash isn’t possible, option 2 is your final avenue.

(2) INCREASE YOUR LOAN AMOUNT AGAINST VALUE

It may be possible to free-up money for the £15,000 value excess by borrowing more money against the £200,000 property value. Let’s crunch the numbers: £160,000 + £15,000 = £175,000 against £200,000 value. You are now borrowing an additional £15,000 and placing a much reduced 12.5% deposit against value, significantly changing the financial landscape of your transaction. Firstly, you are moving from the 80% LTV (loan to value) bracket to 90%, giving lenders less margin of safety. In turn, this will likely mean you pay more interest on a mortgage, putting a squeeze on mortgage affordability. The above also assumes that a lender will approve you for lending at this level, which in reality may not be possible. However, if you have the financial credentials, and you are willing to increase your mortgage costs, this is a valid approach and a common one. I think it’s a shame that the home report system can increase buyers’ borrowing costs, but again I’ll try not to bore you with my irrelevant opinions!

WHERE CAN DISAPPOINTMENT ARISE?

Sadly, the above routes to address a Price v Value excess are not always available to a proportion of clients that we meet. This is because they can’t acquire additional cash funds, or they don’t have the income (or other favourable circumstances) to increase their borrowing against value.

HOW CAN I AVOID DISAPPOINTMENT?

In a strong Scottish property market, it’s important to become familiar with the premiums at which properties are selling above home report value, so you can adjust your expectations and strategy accordingly. Here are my tips on increasing your awareness, or avoiding the issue altogether:

(1) ENGAGE WITH A SOLICITOR EARLY IN THE PROCESS

I cannot emphasise enough how important it is for you to engage with a solicitor early in the property search process. A local solicitor will be involved in property transactions for your target area on a daily basis, and will have a good idea of the offer premiums required to secure the type of property you are seeking. Experts 4 Mortgages can put you in touch with a solicitor who can give you the guidance you need, so you can adapt your budget and expectations before you go on your painstaking property search.

(2) “OFFERS OVER” BEWARE!

Properties in Scotland are often marketed with the phrase “offers over £XXX,XXX”, which is often a figure significantly below that of home report value. This can channel you in to thinking that a property is within your financial reach, when actually it isn’t. This is a good technique for the selling agent, who is looking to tempt interest and show their client that they have done their job in bringing buyers to the door, but not so good for you if you dislike wasted time! Ultimately, in a strong market the “offers over” benchmark is something of a mirage, given that clued up buyers will be arranging their finances around the home report value. For this reason, in my opinion, the home report value is the more relevant starting point for the successful offer price

.

(3) FIXED PRICE LISTINGS

A seller advertising at a fixed price equal or below the home report value eradicates the price/value issue. In a strong market you may see less of such properties listed, but they can “pop-up” and we have seen many clients succeed with a strategy of restricting their search to fixed price listings.

(4) NEW BUILD PROPERTY

New build properties don’t have a home report issued. Your lender will instruct a surveyor to value the property and if this valuation agrees with the developer’s asking price, the transaction doesn’t have any price v value complexity attached. Phew, thank goodness for that!

HOW CAN EXPERTS 4 MORTGAGES HELP ME PLAN FOR THE PRICE v VALUE CONUNDRUM?

We will work with you to make sure your budget includes provision for offering above home report value (where possible), making you aware of the implications so you are fully informed. We deal with this, as a matter of course, for our local Edinburgh clients as well as home-movers coming to Scotland from other countries of the UK. Please do get in touch freely should you have a mortgage related enquiry of this nature.

AN ENDING NOTE OF POSITIVITY

It’s important not to be put off by the above. The home report system has in many ways created a more fluid and functional property market in Scotland. Price versus Value is something to have on your radar, but certainly don’t allow it to derail your home buying aspirations.

WE FEATURE BLOG POSTS TO ENRICH THE CONTENT AND INTEREST IN OUR WEBSITE. THE ABOVE, AND POSTS LIKE IT, DO NOT CONSTITUTE ADVICE, AND THE ACCURACY OF ANY INFORMATION WITHIN IS NOT GUARANTEED